Will Rogers once observed, “Too many people spend money they earned to buy things they don’t want to impress people they don’t like.” Well, those days may be over. Higher mortgage interest rates are reducing the money available to spend and locking people into housing they don’t really like. For example, if your customers are tired of the apartment experience—the noisy neighbors on either side of them or above them—and have decided to buy their way into the American Dream, then they are probably looking for something affordable. Or maybe they have decided to downsize after their offspring have flown the nest, and are ready to trade in their 5,000 square foot home for an easier 2,000 square foot bungalow. Guess what—they’re probably stuck. Are they ready to give up their 3% mortgage for a new mortgage with these kinds of rates:

• 30-year fixed at 8.589%, monthly payment of $1,861 including taxes and insurance

• 15-year fixed at 7.607%, monthly payment of $2,239 including taxes and insurance

• 10/6 ARM at 8.25%, monthly payment of $1,803 including taxes and insurance

Source: Schwab and Rocket Mortgage on October 16, 2023 for a $300,000 purchase, 20% down payment, $240,000 loan, Florida, credit score 700-719

If they had scored the 30-year fixed rate at 3%, their payment would have been only $1,012, and that is the dilemma both first-time and multiple-time buyers face today. How much monthly income should be allocated to housing? PNC Bank suggests the 28% rule—borrowers should keep their mortgage payment under 28% of their gross income. The 28% rule dates back to 19th century calculations during the unification of the German Empire under the Iron Chancellor Otto von Bismarck as he undertook to build a basic welfare state there. His statisticians’ figure that 30% or so of total income was what his citizens should pay for housing, and here we are 150 years later at 28%.

Unfortunately, time and interest rates march on, and that 8.589% 30-year fixed rate mortgage payment of $1,861 per month works out to be about 27% of a $7,000 monthly income. Your customers made it under the 28% rule, but at what cost? They gave up their 3% payment of $1,012 for a new payment of $1,861 and gave up $849 that might have paid for a new car, furniture, appliances, vacations, medical care, etc.

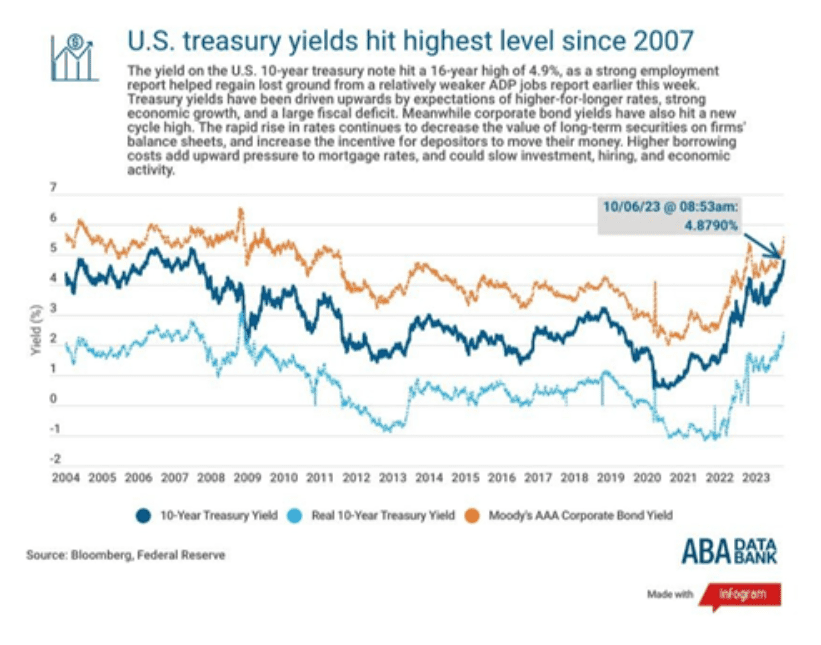

While the Fed tries to whip inflation back into line by raising interest rates, it is also pricing housing out of the reach of taxpayers. The graph below notes that US treasury yields have reached levels not seen since 2007, a year followed by the start of the Great Recession:

What economists fear is that wannabe first-time buyers remain in their apartments and do not spring for consumer durables, like appliances and furniture, and do not consider moving to other parts of the country to take new jobs. They are frozen in place. Moving company business is down and reflecting the stay-at-home decision. New home construction has declined, not just because of continuing supply chain disruptions but because potential buyers cannot afford the price of a new home. The fall in home construction exacerbates the shrinking consumer durables demand as carpeting, refrigerators, dishwashers, freezers, air conditioners, and solar panels begin to stack up in warehouses and their manufacturers begin to lay off their workers. Sure, the job market continues to show lots of jobs in restaurants and hotels, but the job openings are typically minimum wage, and the result is a smaller pay check to cover more expensive rent. All this adds up to possible recession, and this means even higher risk of more loss in household income.

Bankers, lenders and creditors need to pay attention to all interest rates, but especially mortgage interest rates because of their adverse impact on household income– especially disposable income. The decline in new housing, the increases in rent, the slowdown in worker mobility, and the shrinking demand for consumer durables are all red flags of recession, and much of the flag waving stems from mortgage rates. Oscar Wilde suggested: “Anyone who lives within their means suffers from a lack of imagination.” It looks like many Americans are going to have to become more imaginative.