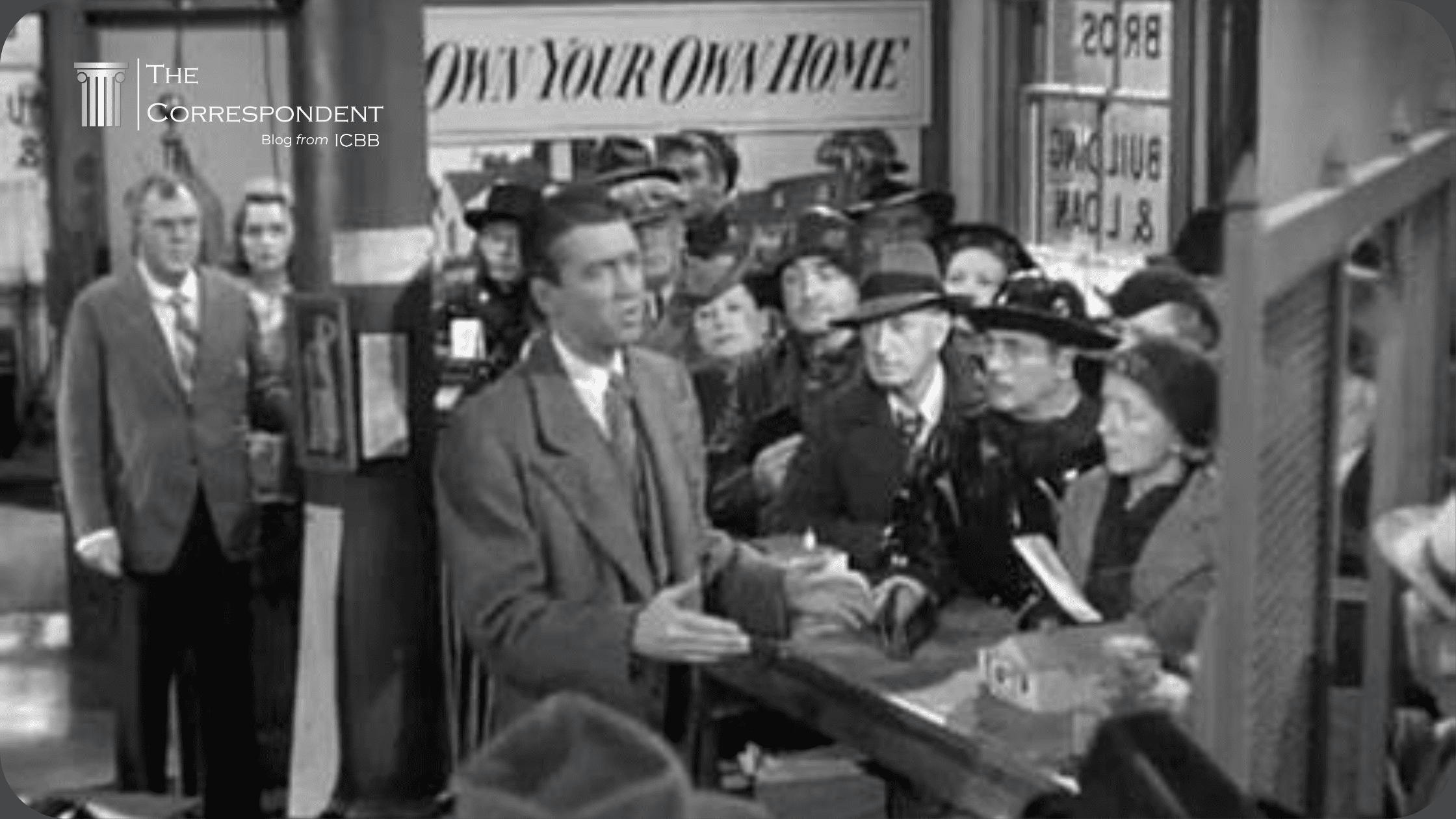

For many people, their favorite holiday memories involve curling up in the living room and watching their favorite Christmas movie with family and friends. Likely a top contender for many is the 1947 classic, “It’s a Wonderful Life.” In this Christmas classic, George Bailey, played by the legendary James Stewart, exemplifies values that resonate with community bankers everywhere: a dedication to the well-being of their towns, a commitment to fostering genuine relationships, and an unwavering belief in the transformative power of banking beyond mere financial transactions.

There seems to be a phenomenon in community banking known as the “accidental banker.” Many employees at community-based financial institutions didn’t begin their career with the intent to become a banker. Yet, years later, there they are. George Bailey seems to be the ultimate accidental banker, continually led back to Bailey Bros. Building & Loan by an unpredictable set of life’s twists and turns. But while George Bailey may lament those twists and turns, the citizens of Bedford Falls thank their lucky stars.

Join us on a journey through the snowy streets of Bedford Falls as we explore the timeless lessons George Bailey imparts, offering community bankers insights that extend far beyond the silver screen. Discover how the principles embodied by this cinematic hero can guide and elevate your approach to community banking, creating a legacy that extends well beyond the balance sheet.

Know Your Why

One of the central themes of the movie is George’s dedication to helping families attain homeownership—a timely goal for today, when the average home price has far overshot the average annual income. A particular scene between George and his father in the beginning of film articulates this perfectly:

“I couldn’t face the rest of my life being cooped up in a shabby little office…” says George. “It’s this business of nickels and dimes, and spending your life trying to figure out how to save three cents on a length of pipe. I’d go crazy. I want to do something big and something important.”

His father, Peter Bailey, answers in this way:

“You know, George, I feel that in a small way, we are doing something important: satisfying a fundamental urge. It’s deep in the race for a man to want his own roof and walls and fireplace. And we’re helping him get those things in our shabby little office.”

Throughout the film, we see George adopt his father’s passion for helping the people in his community into homes. It’s why he stays on at the Bailey Bros. Building & Loan instead of pursuing his passion for travel, or taking a more lucrative job from the miserly Mr. Potter.

So, community banker, what is your why? Who are you most passionately committed to serving? Knowing your why will help you find your niche, set you apart from the competition, and keep you going in tough times.

Build Trust & Reputation

George Bailey’s reputation for integrity and, and his father’s before him, was key to the success of his bank. Even Mr. Potter said, “To the public, Peter Bailey was the Building and Loan.” This speaks volumes to the importance of reputation and personal brand. To your customer, in many ways, you are your bank. Trust is a critical asset in the banking industry, and building it for yourself and your institution should be a top priority. There’s no shortcut to building trust: it’s about showing up for your customers, day in and day out, which brings us to our next lesson:

Put People First

We see early in the film that the Baileys put people over profit. Our first introduction to Peter Bailey is him refusing to bow to pressure from Mr. Potter to foreclose on the homes of his customers. Similarly, George later says this:

“Just remember this, Mr. Potter, that this rabble you’re talking about, they do most of the working and paying and living and dying in this community. Is it too much to have them work and pay and live in a couple of decent rooms and a bath?”

Mr. Potter seems to represent classic corporate greed, and in the short term, he seems to benefit; the man owns most of Bedford Falls, save the Bailey Bros. Building and Loan. No matter how hard he tried, he couldn’t acquire it or kill it. Why?

George Bailey’s primary focus was always on the well-being of the people in his community rather than on maximizing profits. As community bankers, we know that short-term gains are costly if it means disadvantaging the people we serve. Putting people first is not only in line with the spirit of community banking, but builds customer loyalty and a strong reputation.

Show Up in Times of Crisis

George Bailey’s bank was a pillar of support for the community during tough times, such as the Great Depression and a run on the bank. Community bankers in 2023 have seen their own emergencies, including the 2008 financial crisis, pandemic, and even recent rising inflation and interest rates. From George Bailey’s example, community bankers can learn the importance of being a stable and reliable resource during times of need. How can your bank break out of business-as-usual and be of help to struggling customers?

Nurture Relationships

George Bailey’s success was built on strong relationships within the community. He knew his customers, not only by name, but had a clear understanding of their financial situation at all times. This is what sets community bankers apart from our big bank competitors. Community bankers should foster a sense of belonging and interconnectedness by actively engaging in community events, supporting local charities, and getting to know their customers and communities on a deeper level.

Understand the Impact of Your Work

Many seemingly small acts by George Bailey added up to make a huge difference. We see in the end that an entire community was shaped for the better by his actions. Community banking can be a tough business, especially amidst increasing competition and a tough economic environment. For their own sake as well as their customers’, community bankers should take a step back and reflect on the positive influence they can have on the financial well-being of individuals and the overall prosperity of their community. Much like George Bailey, your community wouldn’t be the same without you.

On behalf of ICBB, thank you, community bankers, for all you do to make your communities a better place. Merry Christmas and happy holidays.