These days, social media and search engines like Google are a major part of the buying and selling process in every industry, including banking. A jaw-dropping 81% of people have searched for products and services online, and 45% of social media users turn to social media for information on products and services they’re considering. Your community can leverage this consumer tendency by running paid advertising on social media and search engines to reach new customers. But if you don’t have experience with paid digital advertising, it can be overwhelming to try and execute. That’s why we’ve put together this guide for your community bank.

How Does Digital Advertising Work?

Basically, all digital advertising—both social media and search engine—functions as an auction. You create an ad and then bid on space in your target audience’s social feed or search engine results page. Google and the major social media platforms all have a similar ad creation process, which we outlined below:

Step 1: Choose Your Objective

Before you launch a digital campaign, you must first determine the goal you want to achieve. Do you want people to follow your social media page? Visit your website? Download an application? Fill out your contact form or online application? The campaign builder in the search or social media platform will ask you to choose an objective so they know how to set up your ad and what to measure. Usually, your ad objectives will be separated into categories: often brand awareness, consideration, or conversion. Under these categories, you can choose where to direct people and what metric to measure. Do you want to direct customers to a page on your website and measure clicks? Do you want to build a lead generation form within LinkedIn and direct users to fill it out? There are several possibilities, and you can choose the one that best fits your bank’s goals and needs.

Step 2: Choose Your Targeting

An advantage of digital ads compared to traditional forms of advertising is the ability to specifically target your desired audience. In each platform, you can build an audience to target with your ad based on demographics, geographic area, interests, life stage, and more. You can even save those audiences within your account for future use. For example, if your bank chooses to run an ad promoting your mortgage program, you could target the demographic most likely to be buying homes: users who live in your bank’s zip code, ages 25-45. Note that Facebook poses some restrictions on ads concerning credit and lending. You can still advertise, but your projected audience size may be restricted.

Step 3: Build Your Ad

Once you have established your objective and targeting, you can begin to build your ad! Different platforms offer different ad creative options. Usually, you are required to use at least one image or video (excluding search ads, which are text only); a headline; some description text; a call to action; and a destination URL.

Step 4: Set Budget

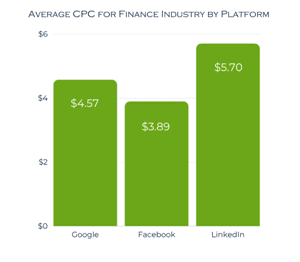

Once your ad is built, you’ll need to set a budget. On most platforms, you have the option of setting a daily budget or a lifetime budget. You can also choose to run the ad continuously or set start and end dates. As with any business decision, your team will want to base your digital ad spend based on your desired result and anticipated returns. Knowing the average cost per click for your industry on each platform gives you a starting point with which to set a budget. Determine the number of site visits or other conversions you would like to gain from the ad and multiply that figure by the average cost per click on your chosen platform. Here’s the average cost per click for the financial services industry on Google, Facebook, and LinkedIn in 2022:

Google: $4.57

Facebook: $3.89

LinkedIn: $5.70

If you’re not sure yet where to aim, begin by setting a daily budget for 30 days and measuring your results. Try starting at $5-10 per day on Facebook and Instagram, $10 per day on LinkedIn, or $10-20 per day on Google.

Step 5: Publish & Monitor Results

Finally, review your ad to make sure that your ad copy, graphics, targeting, and budget are set correctly. Once you publish your ad, there is usually a review period, during which the platform will ensure your ad complies with their advertising policies. Usually, the review period will be less than 24 hours. Once your ad is live, monitor your metrics periodically. Not sure how to interpret your ad metrics? Here are a few terms you may need to know:

Impressions: the number of times a PPC ad was displayed to consumers.

Unique Visitors: the number of different, unique visitors to a website over a specific period.

Clickthrough Rate: The percentage of consumers that click on an ad after viewing it. Calculated as clicks/impressions.

Conversion: the completion of a site transaction or desired action.

Cost per Mille (CPM): the cost of an online ad per 1,000 impressions.

Cost per Click (CPC): the dollar value a marketer spends for a pay per click campaign. Calculated as ad spend/number of clicks.

Bounce Rate: the percentage of website visitors that leave your site before interacting on the page or viewing other web pages within the site.

Sessions: visits to a website, measured in time spent.

Is Digital Marketing Worth It?

In a word, yes. If done well, search engine and social media advertising are cost efficient marketing methods that allow you to specifically target your ideal audience and bring you measurable, profitable results. Your community bank may not see the fruits of your labor overnight, but with consistent effort and best practice, your ideal customers will be led right to your door (or, you know, your website).

Getting the right support from a correspondent banking institution can also serve as an advantage for your community bank. Independent Community Banker’s Bank has established a reputation for excellence over the last 30 years. ICBB serves Community Bank’s throughout Illinois, Indiana, Ohio, Kentucky, West Virginia, and Tennessee to better serve their customers using a variety of services, including credit card solutions and loan participations. To learn more about how we can assist your bank visit www.icbb.bank or contact our Account Executive team solutions@icbb.bank.