Ben Franklin argued: “An investment in knowledge pays the best interest,” so maybe this quick review of how changing interest rates affect your borrowers’ repayment ability will pay off for you. Better to check it out now than worry about it later. As Will Rogers noted: “Worrying is like paying on a debt that may never come due.” Well, even if the debt is coming due, lower interest rates might ease the burden, right? So, let’s just see how lower rates might impact your borrowers’ financials, debt service coverage, real estate collateral value, and size of its capitalized lease debt.

Financial Impact: Very Interesting

That old Chinese curse, “May you live in interesting times,” is timely again as we experience changing interest rates. Many people in the United States had not seen any significant movement in rates since the Great Recession back in 2007-2009, over 15 years ago. The inflation pressure had been building for the past couple of years as the COVID pandemic, supply chain kinks, and the war in Ukraine all did their part in limiting supplies of goods and services as consumer and business demand resurged to drive up prices, especially in 2022.

So, the government solution was to whack the inflation mole with its inflation rate mallet—make borrowing harder by making credit more expensive. Then, the Fed declared victory this summer and started cutting rates.

The Ups and Downs of Interest Rate Volatility: Changing Times

It used to be standard practice for bankers to test a borrower’s repayment ability by jacking up the borrowing rate by 1% or 2% and calculating whether the borrower’s debt service ratio could stand the pressure. This was standard practice until a decade or so ago, because ten years ago, interest rates were flat and continued to lie dormant.

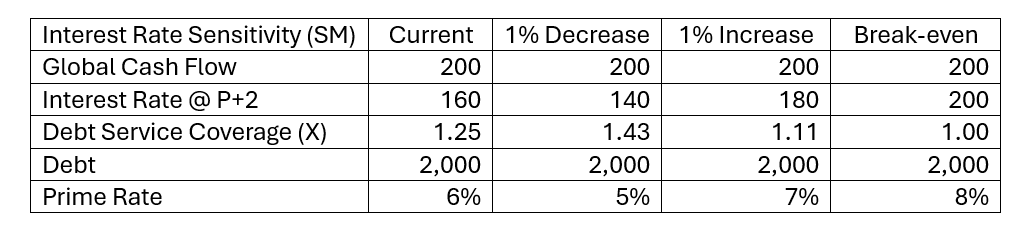

So, for starters, lower interest rates are likely to improve borrower debt service coverage (DSC) ratios structured with cash flow in the numerator and principal & interest in the denominator. The danger is in lulling oneself into assuming rates will not rise again, so at a minimum, lenders should continue to conduct interest rate sensitivity, i.e., testing DSC with lower and higher interest rates to get a sense of how much DSC might change :

This example illustrated how a 1% change in Prime Rate might move DSC, and while a 1% decline boosts DSC to 1.43, a 1% increase drops DSC to 1.11. Not a very robust DSC. Some analysts like to calculate a break-even DSC to determine what interest rate the borrower could tolerate. In this case, an 8% prime rate plunges the DSC to 1.00x.

The long recovery from the Great Recession was also a period of long and low interest rates. If nothing else, the rapid rise in rates and the recent drop in rates should keep lenders on their toes—do the math and prepare accordingly.

Happy Days Here Again for Real Estate?

Another beneficiary of lower rates is the real estate sector because as interest rates decline, so do the cap rates used to value properties. Consider an income-producing property with a $1,000,000 annual net operating income and a 5% cap rate; the appraiser divides the $1MM NOI by 5% to value the property at $20MM. Then, as rates fall, maybe the cap rate drops to 4%, the lower interest rate boosts NOI to $1.1MM, and the real estate is now worth is $27.5MM.

Nevertheless, the prudent thing to do would be to periodically stress-test real estate collateral by monitoring changes in their NOI and cap rates instead of waiting for the next renewal. Like Mark Twain advised: “If it’s your job to eat a frog, it’s best to do it first thing in the morning. And if it’s your job to eat two frogs, it’s best to eat the biggest one first.” So, hop to it.

When You ‘Lease’ Expect It: Lower Rates, Higher Debt?

FASB’s ASC 842 has changed the way we look at leases; any lease longer than 12 months must be capitalized regardless of size. The capitalization process requires that the lease payments be capitalized by the incremental borrowing rate, so if borrowing rates decline, then the lease obligation will increase. As counterintuitive as that may seem, what lenders need to evaluate is whether the higher capitalized lease obligations will push a borrower over any maximum leverage ratio covenant or under any current ratio covenant minimum. A larger lease obligation will also probably increase the current portion of lease debt, and all things being equal, the larger current debt relative to the current assets is likely to reduce the current ratio.

Two Out of Three Ain’t Bad

We can take comfort from Isaac Newton’s study of gravity: “What goes up must come down.” We don’t need to be conked on the head by an apple to know that interest rate cuts are generally good for borrowers and lenders in a couple of situations: debt service ratios improve, and real estate collateral values increase. But that doesn’t mean we should relax our vigil. It’s time to start stress-testing interest rate coverage when we measure DSC ratios, and it’s time to monitor the impact of interest rate changes on the NOI and cap rates of real estate collateral. However, the third time is not so good because lower interest rates are likely to increase capitalized lease debt and lower current ratios for borrowers who lease some of their assets. So, periodically check your borrowers’ leverage capacity for higher lease debt and more current debt. But stay positive—like Meat Loaf sang back in 1977: “Now don’t be sad, ‘cause two out of three ain’t bad.”