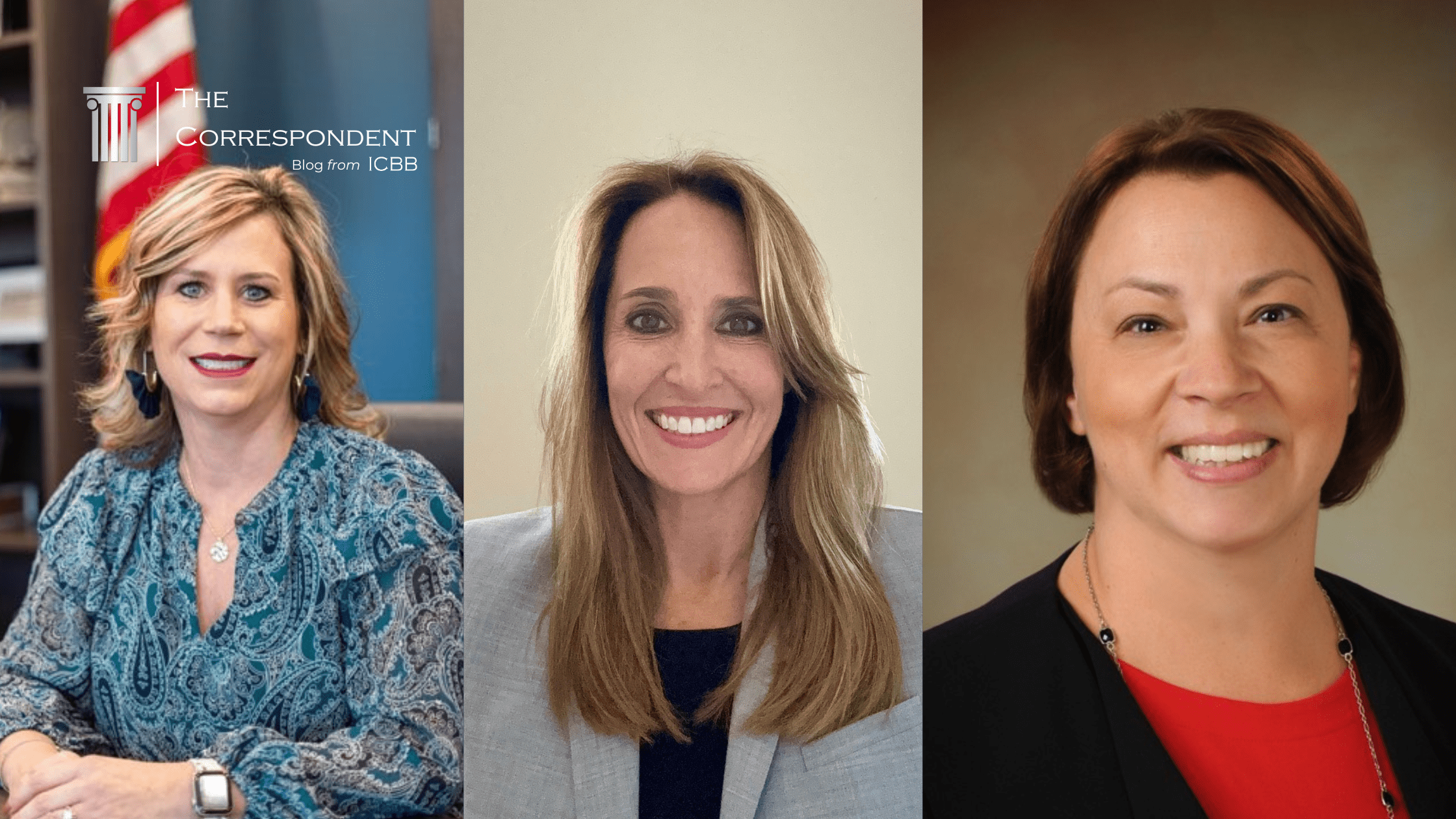

We’ve declared March Women in Banking Month! To celebrate, we’re profiling a few of the many outstanding women in community banking. As of 2021, only 10 of the largest banks in the U.S. boasted a female CEO. Community banking is ahead of the curve in this area, with many institutions led by women as president and CEO. We’ve interviewed three of them below: Susan Barber, president and CEO of Community Bank Parkersburg in Parkersburg, West Virginia; Ilaria Rawlins, proposed president and CEO of Fortuna Bank (in organization) in Columbus, Ohio; and Deena London, president and CEO of Magnolia Bank in Hodgenville, Kentucky*.

*Some answers have been edited for length and clarity

Susan Barber

President & CEO

Community Bank Parkersburg

Parkersburg, WV

How did you begin your community banking career? Did you always plan to go into banking?

I started my career in community banking by way of my career as a certified public accountant. In 1997, I joined the firm of Arnett & Foster as a staff accountant. I spent the next 20 years focusing on audits and consulting work for community banks. As an auditor, I was exposed to many different industries. However, the banking industry was my favorite, and I asked to specialize in that industry. In 2019, I made the leap to Community Bank of Parkersburg as their President.

What has been the biggest challenge you’ve faced in your career?

As bankers, we face challenges every day. Whether it be regulatory requirements, economic changes, or just running the day to day – we weather many storms and juggle many roles. It is keeping all those balls in the air while weighing the impact on customers, employees, the community, shareholders and the regulators that proves to be the biggest challenge.

How or by whom have you been mentored in your career?

The former partner in charge of the financial institution practice at Arnett & Foster, Jack Rossi. He is currently an Executive Vice President of Business Development with Summit Community Bank. He taught me banking and he reinforced quality customer service. He often told me that he was hard on me to make me better, and he did make me better.

What key skills or qualities do you think it takes to be successful in community banking?

I think being a successful community banker is to keep your customer at the forefront of your mind. We need to remember that as bankers we are a part of every important life decision of our customers. We are their trusted advisor and it is an honor to hold that position.

What advice would you give to young women aspiring to build a career in community banking?

Find a female role model. Watch as that woman juggles work, family and finding their way in the professional world. Then take that to heart and believe you can do it as well.

Ilaria Rawlins

Proposed CEO

Fortuna Bank (in organization)

Columbus, OH

How did you begin your community banking career? Did you always plan to go into banking?

I went to college with aspirations of being a news anchor! Halfway through my college career I took an economics class and fell in love. Upon graduation I landed my first banking role as a personal banker. I never intended to stay, but I really enjoyed meeting with clients, talking with them, helping them during their biggest life moments and ultimately coaching the next generation of bankers.

What career accomplishment are you most proud of?

Working hard to bring a women-owned and women-led bank to life. There are 14 women-owned banks in the entire country, out of 4,300+ banks. The financial literacy gap for women is real, and it’s not necessarily day to day money management– we’ve been doing that for years– but it’s saving for retirement and making informed, confident decisions. Women stand to inherit the majority of the great wealth transfer taking place now. We have to be intentional in making this change.

What has been the biggest challenge you’ve faced in your career?

I don’t think this is unique to banking, however the struggle to find balance between being a mom and having a career is real.

How or by whom have you been mentored in your career?

Mentoring did not really happen for me until later in my career. However, I have two great mentors who listened, acted upon my asks and pushed me harder than anyone ever had before. Tony Stollings, former President for First Financial Bancorp, listened when I said I wanted the next opportunity. We’ve remained close and he is still mentoring me today as we are working together to build this new bank. He will be our initial CFO and director for the bank. Additionally, Cathy Meyers Chief Consumer Banking Officer for First Financial Bank taught me that I could do hard things, was a champion of mine, and forced me out of my comfort zone.

What key skills or qualities do you think it takes to be successful in community banking?

Banking is built on relationships, and while it sounds very cliche, you have to have a passion for building relationships, wanting to help people and businesses, and the desire to be woven into the fabric of the community.

What advice would you give to young women aspiring to build a career in community banking?

Use your voice. Stretch yourself out of your comfort zone. Learn how to give presentations and become comfortable with public speaking. Learn about your community and get involved. Find friends in other departments of your bank.

Deena London

President & CEO

Magnolia Bank

Hodgenville, KY

How did you begin your community banking career? Did you always plan to go into banking?

I began my career in banking right after high school graduation. I worked part-time as a teller while attending college full-time. I was a young single mother and needed full-time pay and benefits, so I accepted a position at Magnolia Bank where I moved into accounting—and have held many titles and positions ever since. I “fell” into banking and never left.

What career accomplishment are you most proud of?

Being named the fifth President of the bank in 2019 as we were celebrating our 100th anniversary year.

What has been the biggest challenge you’ve faced in your career?

Shifting my work style from “getting things done” to being the one to direct change, especially when I know the change is going to disrupt the organization. This occurred in 2022 when we were making the decision to switch core processing providers. In the past, I was the project lead and this time my role was executive sponsor. I knew what a weight it would be on the bank and project team, but it was what was needed to open other opportunities.

Can you share a lesson from your career that has had a lasting impact on you?

Use each “mistake” as an opportunity to learn and improve. Perfection is unobtainable but excellence should always be the goal, personally and professionally.

How or by whom have you been mentored in your career?

Our past President and CEO Ron Sanders invested in me from my very first day. He encouraged me to finish my education and ensured I was given opportunities to grow in my knowledge and leadership.

What key skills or qualities do you think it takes to be successful in community banking?

Adaptiveness and flexibility—the industry is changing at an accelerated pace. Competition is growing in areas we never expected. Being adaptive and flexible helps maintain relevance in our changing world.

What advice would you give to young women aspiring to build a career in community banking?

Seek opportunities to stretch yourself personally and professionally. Growth occurs most during those times when we step outside our comfort zones and tackle challenges.