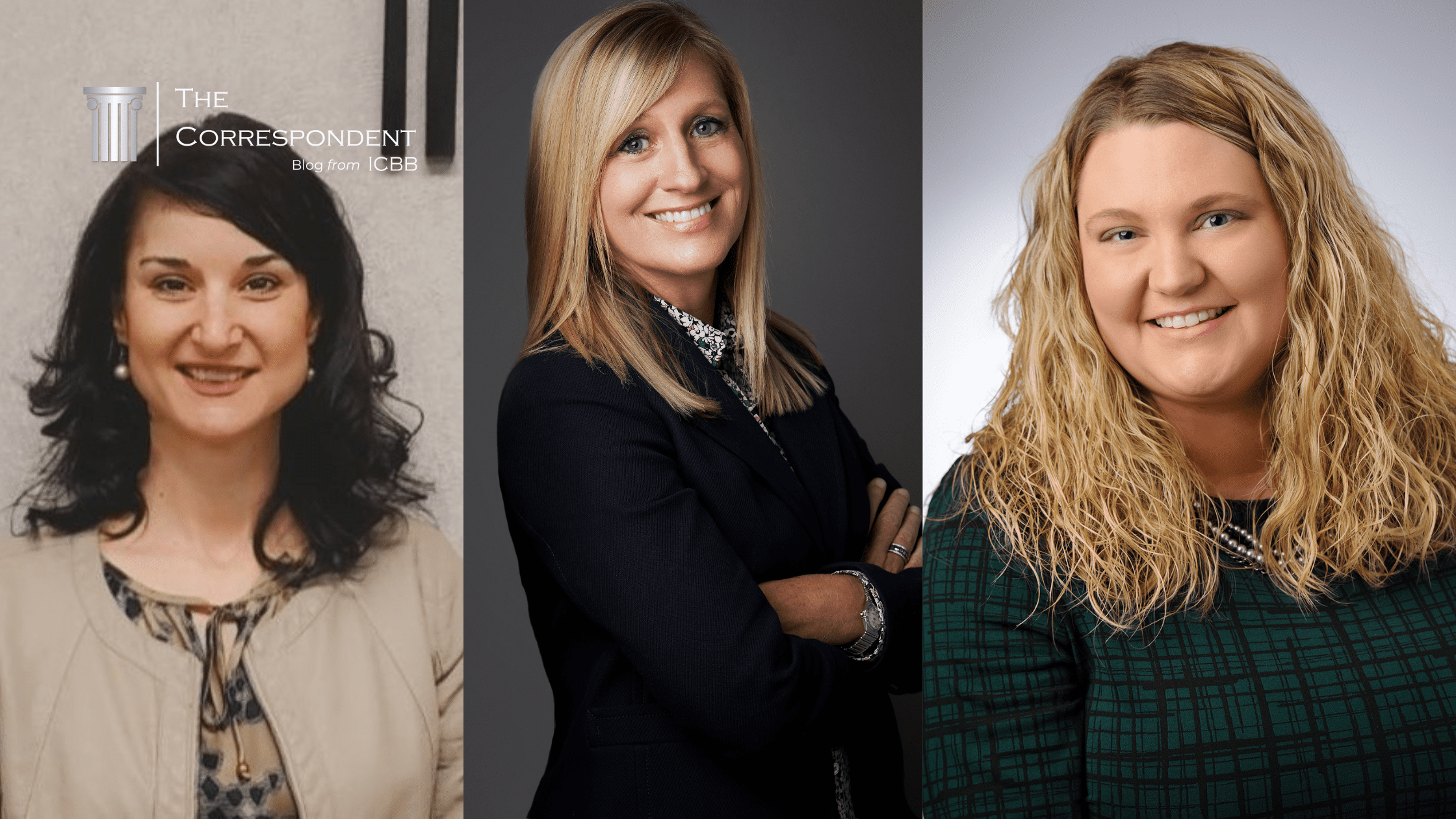

We’ve declared March Women in Banking Month! To celebrate, we’re profiling a few of the many outstanding women in community banking. Community banking is full of incredible marketers, including this week’s features: Susan Guess, chief marketing officer at Paducah Bank in Paducah, Kentucky; Gina Kocher, director of marketing and business development at Trust Bank in Olney, Illinois; and Kayla Carroll, marketing director at CG Bank in Stanton, Kentucky.*

*Some answers have been edited for length and clarity

Susan Guess

Chief Marketing Officer

Paducah Bank

Paducah, KY

How did you begin your community banking career? Did you always plan to go into banking?

I just celebrated my 25th anniversary at Paducah Bank and in banking. There were no plans for a banking career but I’m glad it found me.

What career accomplishment are you most proud of?

One of the career milestones I hold in high esteem is undoubtedly my educational journey. As one of nine siblings, I take particular pride in being the sole recipient of a college degree within my family. This achievement has not only set a distinct path for my career but has also, in many respects, facilitated a smoother journey through life for me. The pinnacle of this educational journey was serving as Chairwoman of the Board of Regents at Murray State University. When asked how ‘a girl from Farmington’ achieved such a position, my response has always been, ‘Why not a girl from Farmington?’ This role underscored the value I place on education, which stems from the doors it has opened and the myriad of opportunities it has presented. More than just an academic accomplishment, my education has been a cornerstone in nurturing a mindset geared towards embracing boldness and a commitment to lifelong learning. These principles have been especially critical in the field of marketing, where the landscape has undergone profound changes in a remarkably short period. Staying adaptable and continuously seeking new knowledge have been key to navigating these shifts successfully.

What has been the biggest challenge you’ve faced in your career?

Undoubtedly, the most formidable challenge I encountered in my career coincided with a pivotal personal milestone—becoming a mother for the first time. This juncture required me to balance my professional ambitions with my new role as a parent. Remarkably, the bank played a crucial role in this chapter of my life by offering me the flexibility to work according to a schedule that accommodated both my professional responsibilities and my duties as a new mother. This was over two decades ago, a time when the concept of remote work was a rarity rather than the norm. This experience was not just about balancing two vital aspects of my life; it was a profound lesson in the power of advocacy and communication. It taught me that articulating your needs can lead to positive outcomes, often resulting in the support and accommodations necessary for success. The bank’s willingness to adapt and support me during this time is a testament to its progressive, employee-first ethos, which I believe sets it apart in the industry.

Can you share a memorable experience or lesson from your career that has had a lasting impact on you?

One pivotal lesson from my career that resonates deeply with me is that success is inherently collaborative. It’s a collective achievement, not a solitary triumph, and should always be celebrated with those who contribute to it. I’ve often been recognized for accomplishments that truly belong to our team—a talented local ensemble specializing in graphic design, photography, and the written word. This experience has underscored the importance of valuing the diverse skills and contributions of each team member. Earlier in my career, I felt compelled to prove my worth by trying to do everything myself. However, over time, I’ve learned that the essence of meaningful success lies in the synergy of combining individual strengths to create stories that not only bring pride to ourselves but also elevate our entire organization.

How or by whom have you been mentored in your career?

I’m grateful for an army of people who have encouraged, supported and pushed me to be my biggest and best self. Among my supporters is a core group of men and women who have helped me with leadership opportunities within our community and on the statewide level. They have been my sounding board and have provided frank and supportive guidance on how to continue a forward path of growth, success and meaningful impact.

What key skills or qualities do you think it takes to be successful in community banking?

Success in community banking is deeply rooted in a dual commitment: a consistent focus on the needs of our customers and community, and the flexibility to adapt to their evolving landscapes. This adaptability is crucial for responding effectively to changes and addressing the diverse needs of our community members with relevant and beneficial services. Moreover, my personal approach has always been to stay alert and responsive to the daily shifts in market trends, community dynamics, and customer needs. This mindset steers me away from rigidly adhering to a predetermined content calendar that may not align with current events or sentiments. The richness of stories and achievements within our community and customer base is vast, and it’s essential to remain open and fluid in our planning to celebrate and share these moments meaningfully. This balance of understanding traditional banking needs while being agile enough to innovate and respond to new challenges is what I believe truly defines success in community banking.

What advice would you give to young women aspiring to build a career in community banking?

Be bold. Be yourself and be willing to get uncomfortable. I would also encourage her to be a bit troublemaker. I find that all too often people aren’t willing to speak up. Be willing to challenge and question the “no’s” you get.

Gina Kocher

Director of Marketing & Business Development Officer

TrustBank

Olney, IL

How did you begin your community banking career? Did you always plan to go into banking?

I have always been interested in marketing, from the psychology to the design components, but my passion for teaching directed my college pathway. After 16 years as a public school teacher, I was exploring the opportunities in my area when the position of Director of Marketing for TrustBank was offered to me. It was a bit of a fluke, but I’m so glad I trusted in my ability to learn a completely new role.

What career accomplishment are you most proud of?

Not having a marketing degree, I am most proud of how much I have learned in the last three years. It has been quite the learning curve, but I’m appreciative of those at TrustBank who have guided me along the way, other bank marketers who have shared best practices, and the resources offered to community banks from various associations.

What has been the biggest challenge you’ve faced in your career?

Since I started at TrustBank, we have built a building, acquired a bank, and opened a bank in a new market. With my role, I have been intertwined throughout the process of each of these and it has been eye opening. It was equally exhausting and exhilarating!

Can you share a memorable experience or lesson from your career that has had a lasting impact on you?

As someone who works with everyone in the organization, I think an oft overlooked skill is empathy. This allows one to develop better relationships, gain a solid understanding of what a customer needs, and solve the pain points, both internally and with our clients.

How or by whom have you been mentored in your career?

I have been blessed to have a leadership team who was willing to guide and teach me these past years, especially the CEO. I had members of our TrustBank team who have patiently walked me through our specific events and volunteer activities, and introduced me to the communities in which we have locations. My mentor coached me through it all and gave me insight into the organization. Her guidance saved me hours of work and probably a few years of my life!

What key skills or qualities do you think it takes to be successful in community banking?

With the whiplash innovation happening in how people consume information and how they bank, it is key to be someone who continues to learn. You must also be plugged into the communities you serve, listen to feedback from those in the organization, and remember to never be married to an idea. I believe in loosely-held strong opinions. Have a well-formed idea and present it, but be open to alterations or hearing, ‘no’.

What advice would you give to young women aspiring to build a career in community banking?

Develop your skill sets to be diverse. Develop your relationships to be genuine. Develop yourself to achieve goals. Even 10 minutes a day spent focusing on these can result in intense benefits.

Kayla Carroll

Marketing Director

CG Bank

Stanton, KY

How did you begin your community banking career? Did you always plan to go into banking?

When I walk into high school classrooms to speak to seniors, I always tell them, “If you had told me as a high school senior that I would be a banker, I would have said that you are crazy!” After graduating from Morehead State University, this opportunity was presented to start my banking career in the community in which I was born and raised.

What career accomplishment are you most proud of?

I am most proud of being able to give back to the community that has given me so much: from reading to kindergarteners, to participating in middle school Reality Stores, to speaking to high school seniors about finances before they head off to college. All these events are so rewarding for me. I hope to be able to share things that will make an impact on their lives.

I like to share my favorite quote, by Minor Myers, at these events: “Go into the world and do well. But more importantly, go into the world and do good.”

Can you share a memorable experience or lesson from your career that has had a lasting impact on you?

The networks I have created during my time in community banking have led to many lasting experiences. My network has connected me to many boards and community groups that have truly enhanced my life. Currently, I serve as the Chair of the Mercy Health Marcum & Wallace Foundation Board which has let me use my community network to help give back to a medical facility that is a true community partner, providing exceptional care.

How or by whom have you been mentored in your career?

I give gratitude to two wonderful women in banking that have helped mold and shape my banking career. First, Deborah Tipton (Retired, Executive Vice President), taught me the fundamentals of banking operations. She helped build the foundations of my career which has gotten me where I am today.

Second, Kathy Samples (Retired, CEO/Board Chair), who believed in my banking knowledge and skills and helped me make the transition into full-time bank marketing. Kathy has taught me to lead with dignity, gratitude, and respect. She taught me the true importance of community and being dedicated to your community.

What key skills or qualities do you think it takes to be successful in community banking?

“Community” is the key. It is vital to being able to connect with your friends, your neighbors, and your community. I always say that “community is my favorite part of the job.” I love people and love being able to give back in so many ways to a community who has done so much for us.

What advice would you give to young women aspiring to build a career in community banking?

My advice would be “take advantage of every moment and experience as a learning tool. Your mentors are there to help guide and teach you, so soak up every drop that you can! Relationships and networks are everything!”