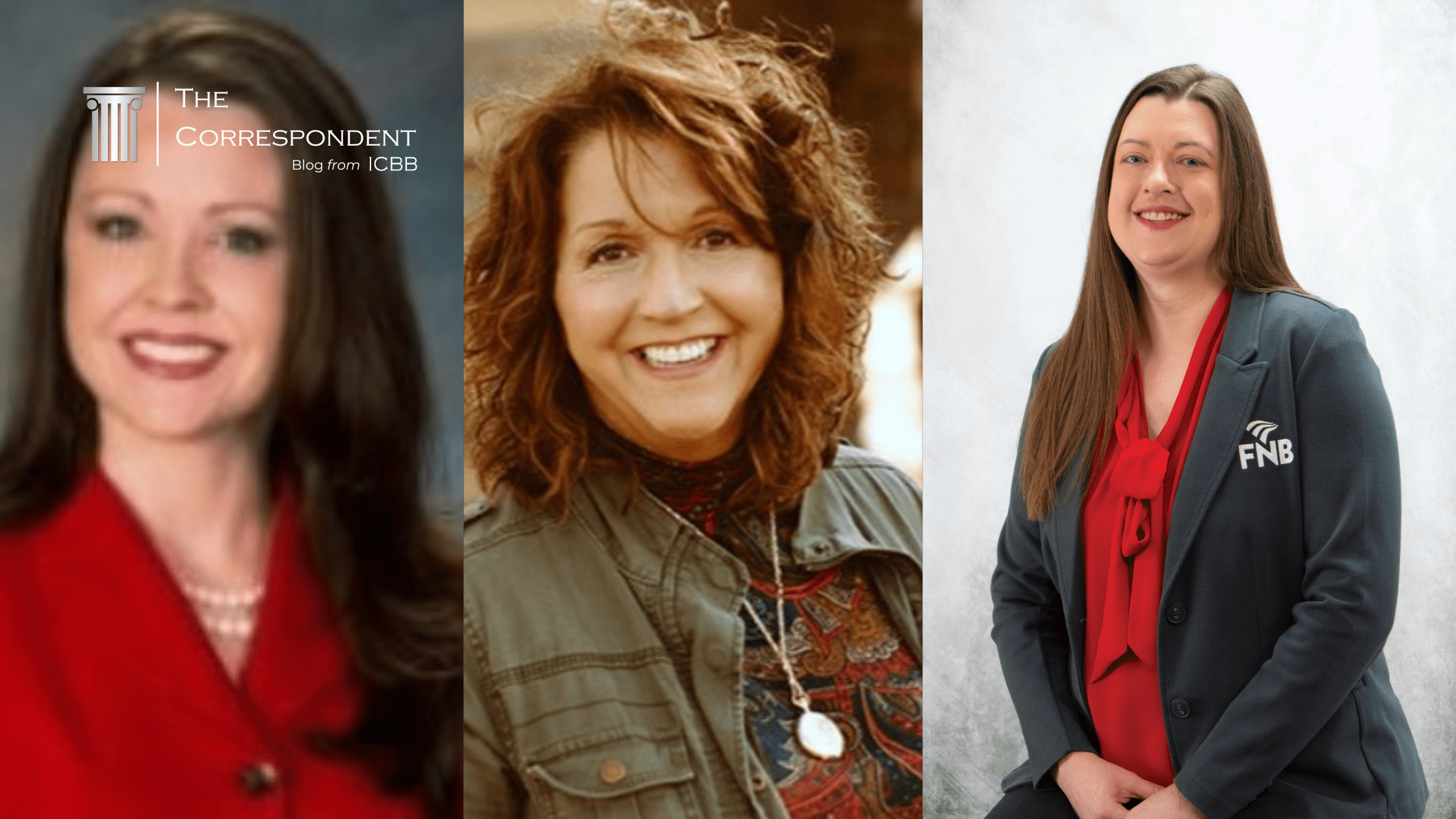

We’ve declared March Women in Banking Month! To celebrate, we’re profiling a few of the many outstanding women in community banking. Community banking is full of incredible operations professionals, including this week’s features: Christy Carpenter, chief technology officer at Springfield State Bank in Springfield, Kentucky; Jennifer Franklin, VP and operations officer at FNB Bank in Mayfield, Kentucky; and Melissa Knight, president at Farmers National Bank in Lebanon, Kentucky.*

*Some answers have been edited for length and clarity

Christy Carpenter

EVP & Chief Technology Officer

Springfield State Bank

Springfield, KY

How did you begin your community banking career?

I began in 1989, and banking was the last thing I wanted to do. I hadn’t gone to college yet, and I was just looking for a job with good benefits and hours that would align with my child care. I started out in bookkeeping, back in the days when we filed paper checks most of the day. Things were very simple then compared to now. I had taken some computer programming classes at the local college, and at the time our bank had one live computer. Everything else was a dumb terminal connected to the processor. One caveat of my hiring was that I would expand usage of that one computer, in addition to my bookkeeping duties. So, after I would get my bookkeeping work done, I spent time building spreadsheets for the board reports, loan reviews, stockholder information, and asset liability management. I didn’t know what most of that was, but I learned by doing.

What career accomplishment are you most proud of?

I’ve worked every single job in my bank, and by 1999, I had set up a small peer to peer network, and some shared printers. The loan officers now had live computers in their offices, and were originating loans there – instead of using the ‘one’ computer we had prior. So, I saw an opportunity to bring our processing in house to save the bank A LOT of money, and increase efficiency and access to our data. I purchased computers for every employee, managed the network setup and installed an in-house operating system and started putting together the best technology team of any bank in the country. Our efficiency ratio is proof, it’s been the best thing our bank has ever done. Examiners and auditors agree, that our system is second to none in data access and manageability and while regulators were iffy on in house processing in the beginning, we’ve worked hard to make it great – and we have!

Another highlight in my career was a total surprise to me. In July 2016 I had just given my technology update report to the board of directors, and came back down to my office. My phone rang, and they asked me to come back up to the meeting. They invited me to be a member of the Springfield State Bank Board of Directors. I was the first female to serve on our board. I love our bank – always have. So, to be invited to our board was a monumental honor.

What has been the biggest challenge you’ve faced in your career?

Back in the 80’s, it was very much a man’s world. So, I never really envisioned being considered for management or leadership. I remember when I first started going to conferences and meetings, and being the only skirt in the room. It was terrifying, and it took me awhile to feel comfortable having a seat at that table. But I have to really commend the professional men I met along the way, and how supportive, understanding and encouraging to me – especially the ones in my own bank. They mentored me and rewarded my hard work.

The other great challenge was going into my career without a college degree. After I realized I would stay in banking, I spoke with my president to see if completing my degree would bring me more opportunities, and he provided all the education I needed through the banking school programs to set me up for success. I’ve learned by doing, and by getting the training I needed, as I needed it. It took me a long time to feel secure in my own skin around so many people with their incredible degrees, but what I lack in paperwork, I make up for in a vast amount of experience and “figuring it out”.

How or by whom have you been mentored in your career?

When I began working at the bank, Gary Clifton was a VP and he was soon leaving to start his own bank. He started teaching me all facets of his job and we worked together on the technology side of things, as he was the outgoing “EDP Officer.” He taught me so much. When our current president, Robbie Polin, was appointed president in 1993, I expressed my interest in wanting to succeed at the bank and asked him what I needed to do to make that happen. He said “watch me. I will show you.” And he sure did. He has taught me all facets of banking, and out of that conversation came all the open doors for learning and achieving success at the bank, and for the bank.

What key skills or qualities do you think it takes to be successful in community banking?

I have a saying… when someone asks me, “what do you do at the bank?” My response is “whatever it takes”. I think a successful community banker has to know up front that we face unique challenges. And we have to be willing to bravely embrace those, and not give up. We do all the big bank things! But we don’t have the large pool of staff the big banks have to draw from, and we are in a rural area. We are so fortunate to have a well-seasoned, committed staff. And they all embrace that same mentality – “whatever it takes”. When we are short-handed, everyone pitches in. And we work together like a family on the family farm. We work hard, and smart, and we care about each other.

What advice would you give to young women aspiring to build a career in community banking?

Don’t have any preconceived notions. All Kentucky banks just want each other to win. Develop a good network of other bankers you can learn from and help. Always be willing to do the dirty work, because it’s not just the work that needs to be done – but the humility you learn from doing so. Work in every department of your bank. You will get a true appreciation and empathy for what each employee faces each day, and you can find ways to improve processes and efficiencies for your bank. Above all things, be true to yourself, and who you are as a person. Women aren’t expected to become men. We bring something very special to the table by being who we are. It takes all kinds! Never compromise who you were meant to be, for anyone.

Jennifer Franklin

VP & Operations Officer

FNB Bank

Mayfield, KY

How did you begin your community banking career? Did you always plan to go into banking?

I always wanted to have a career in business and finance, though I did not specifically see myself as a banker. When I finished college and was ready to start my career, it was important for me to stay close to home, and to find an organization that supported my local community. Fortunately, a position came available at a community bank that completely fit the bill! Once I got a taste of community banking, I couldn’t imagine doing anything else.

What has been the biggest challenge you’ve faced in your career?

A little over 2 years ago, we lost both our main office and our operations center in a tornado. If that doesn’t prove resilience in a team, I don’t know what will! Our leaders led through experiences they never imagined would be part of their job descriptions, and our team joined in with their relentless support and persevered through without complaint or hesitation.

Can you share a memorable experience or lesson from your career that has had a lasting impact on you?

I learned relatively early on in my career that the way you do something may not always be best. Different people may do things differently, but as long as we follow the rules and get to the same goals, that’s okay! I spent a lot of time trying to teach people “this is the way” without the open mindedness to see that their way was working better for them. Realizing that different methods can get us across the finish line just as efficiently (and just as correctly) has made me a better supervisor, and a better banker overall.

How or by whom have you been mentored in your career?

I have worked with many talented and skilled bankers throughout my career. I believe there is something to learn from each coworker that you encounter, and I try to bring out people’s best qualities so that I can learn from them. That being said, I have been so blessed to have had the opportunity to work under our President & CEO, Sally Hopkins. She is the perfect picture of a leader, and has undoubtedly played a huge role in shaping the banker that I am today.

What key skills or qualities do you think it takes to be successful in community banking?

To be a successful community banker, you’ve got to understand that the community part is what is going to set you, and your bank, apart. All bankers have to know the ins and outs of loans and deposit accounts, of bank policies and federal regulations, but community bankers have an extra charge. They must know their customers by name, they have to be prepared to have conversations at the grocery, at a Friday night football game, or via text on a Sunday afternoon when a friend from church lost their debit card. Those extras are what are going to make you not just a successful banker, but a successful community banker.

What advice would you give to young women aspiring to build a career in community banking?

First, I would say if you haven’t considered a career in banking, you may want to. There are more opportunities than the front-line roles that people automatically think of when they think of banking. Community banking offers careers in operations, accounting, IT, Human resources, marketing, and many other areas. If you decide to explore a career in community banking, be open minded, resilient, and work hard every day! Be the banker that you want to be, be willing to take on different roles and try new things, even if they are challenging (especially if they are challenging!). It is a rewarding and fulfilling career where female leaders are becoming more prominent and successful every day.

Melissa Knight

President

Farmers National Bank of Lebanon

Lebanon, KY

How did you begin your community banking career? Did you always plan to into banking?

My first job in banking was event planning for the Firstar Balloon Classic in Bowling Green, Kentucky. I recruited and organized teams of volunteers to assist in lift off and then chase the hot air balloons. I also helped prepare for the concerts in the evening; one of the first I worked was an up-and-coming country group called the Dixie Chicks! Following that, I worked as a teller who rotated through various branches in Bowling Green. During that time, the bank changed hands from Trans-Financial to Star Banc to Firstar all in 1998, which later became U.S Bank in 2001. At that point, I didn’t think of myself as a “banker,” but a college student who worked at a bank. I left banking and Kentucky when I graduated and moved to San Jose, California to work for IBM Research Center in 1999.

In 2003, when I moved home from California, I was approached by Gene Spragens who asked me to come work for his bank, Farmers National Bank of Lebanon. He did not have a position for me, but rather an idea about developing more events for the Bank customers and the community. So, from the start, I was inventing my job as I went along. I started as the marketing director and was responsible for advertising, public relations, charitable giving, events, and establishing a club for bank customers interested in financial education, social events, the arts, and travel.

Over time, I became involved in more and more areas of the bank including strategic planning, human resources, project management, compliance, teller operations, new accounts, product development, and loan committee. Along the way, I really learned just how much a community bank does for its customers and the community as a whole and I fell in love with banking.

What career accomplishments are you most proud of?

I am most proud of being named the first female president of Farmers National Bank. FNB is a third-generation family-owned community bank. CEO George B. Spragens named me president in 2015 and I am so thankful that he believes in me. I was hired by his father T.E. “Gene” Spragens and spent a great deal of time with him and his wife, Nadine, before they passed. I saw and experienced first-hand how they genuinely cared for the staff like family and gave of their time, talent, and treasure to the community, the state, and the banking industry. To this day I meet people all over the state who knew them, and people have the utmost respect for their mission and values. I feel honored to be trusted to carry on that tradition and legacy. I take this responsibility very seriously.

What has been the biggest challenge you’ve faced in your career?

Being the first female bank president created an added layer of pressure to an already stressful position. I learned quickly that I needed a trusted circle of peers which I could rely upon when I needed to voice ideas or ask for unbiased advice. The other biggest challenge continues to be finding time to do everything I want to do. Running a bank and raising a family of five children while serving in various organizations at the local and State level takes careful calendar coordination. I have come to understand that even with an amazing, supportive spouse like mine, while you can do it all, there are times when you simply cannot do it all at once, and that’s okay! I keep my priorities straight and say “not right now” when I just can’t fit something into my schedule.

Can you share a memorable experience or lesson from your career that has a lasting impact on you?

In 2005, the Bank’s CEO and President Gene Spragens stopped by my office and we chatted about a new project we were working on—an internet café and coffee shop of sorts for our travel club members where we would host speakers and events. Gene left for a day of golf with some friends and that was the last time I spoke with him. He passed away suddenly on the golf course. It was a time of overwhelming sorrow for the family, bank, and the whole community.

As the shock began to wear off, I remember a feeling of unease that hung like fog in the staff. What will happen now? How will the Bank continue without Gene? But the bank did continue with the leadership of his son George Spragens and EVP Jim Richardson. And I observed that because Gene had lived and run his bank by such clear and unwavering core values, he had prepared us all for this. There was never a doubt when we asked ourselves, what would Gene and Nadine have wanted? How would they handle this situation? It taught me that leadership like this is how you build a strong culture and leave a legacy that outlives you.

How or by whom have you been mentored in your career?

I can’t say that I’ve had a formal long-term mentor/ mentee relationship in my career. However, over time I can now look back and see many people I met along the way from my time at Western Kentucky University to IBM, to Pepsi, and all my 24 years in banking. Along the way, I have been fortunate to encounter so many leaders, both men and women, who taught me about the right way, and sometimes the wrong way, to get things done.

Gene Spragens had a knack for showing you what he wanted to accomplish. He would give you the big ideas, his vision, sometimes with detailed descriptions. He might orchestrate a meeting or lunch with a third party who he thought was doing a great job with a similar project, but then he would step back and leave the rest to you. He may or may not have thought I did it the way he would have, but he never let on! Always supportive, he let you grow and learn that way, and I have carried that practice with me as I have mentored younger managers in our Bank.

Some female mentors I have been fortunate to learn from were not in banking, but were navigating other traditionally male roles in their industries including economic development, technology research, sales, and law. Carolyn Wallace (IBM Research Center) taught me to set up my own personal values, find an organization to work for that shares those values, and then make decisions that do not waiver from those. That advice was the basis for the strategic planning we have accomplished over the years at FNB. We are a family and we treat our customers like family. We strive daily to live up to our collective values. That advice has served me well.

What key skills or qualities do you think it takes to be successful in community banking?

There are some essential qualities I think community banking requires to be successful over the long-term:

Honesty– being truthful and transparent

Integrity– being consistent in your behavior and convictions

Curiosity– being willing to ask questions and learn new things

Ability to build trust with staff and customers who will follow you, if only out of curiosity

Ability to adapt to change both in the industry as a whole and in the day-to-day operations of the bank

Empathy– being able to see things from other’s perspectives (customers, auditors, regulators, employees) and understand why their views are that way. This is imperative to successful communication.

What advice would you give young women aspiring to build a career in community banking?

Go for it! Women are especially adept at banking for so many reasons. We tend to be able to multitask, plan, and organize. We are naturally more empathetic and tend to be more expressive communicators, all of which are great skills for banking.

Banking isn’t just one kind of job, but a career that can be as varied as you want. There are so many fields in banking from analysis-based jobs like credit analysis, auditors, and compliance officers to relationship, social-based jobs like tellers, branch managers, universal bankers, and human resources. Then there are also those jobs suited for people who can manage numbers as well as relationships like lenders, relationships bankers, market presidents, etc. And now more than ever, bankers who know and understand technology, software, hardware, and fraud prevention are in high demand.

If you want to learn about what a career in banking might be like, reach out to a local banker and ask for a coffee break or lunch discussion or inquire if they host students for a shadow day or week. We are all excited to share our experiences and opportunities!